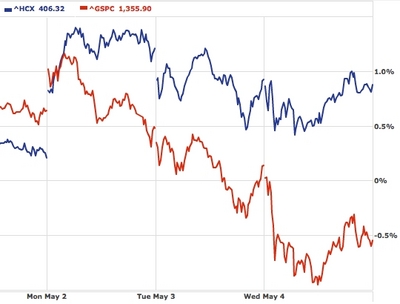

How about this for the chart of the day?:

S&P Health Care Index, in blue, gains, while broader S&P 500 Index, in red, lags. |

Since the news of Bin Laden's killing on Sunday night, and the attendant boost to President Obama in the polls, the S&P Health Care Index has traded up, while the broader market, represented by the S&P 500, has lagged. I wouldn't want to put too much weight on three days worth of data — many investors have much longer time horizons, and it's certainly possible that there are explanations for the variance that don't relate to Bin Laden. Still, it's not too hard to come up with a story to explain this. If Mr. Obama is re-elected, he'd almost certainly veto any effort to repeal or de-fund ObamaCare. It'd also be unlikely, in such a scenario, that Republicans would achieve a large enough majority to override a presidential veto. So ObamaCare — which, is, among other things, a big program to tax other parts of the economy to pay for more health care — would go forward, which means more revenue, and more profit, for those companies in the health care index. One might take a longer-term view, which is that ObamaCare will eventually lead to price controls for health insurance and pharmaceutical companies, which will hurt their profits. But at least in the short to medium term, ObamaCare also means a lot more customers for those companies, and more consumption by existing customers, which is why a lot of the companies and their trade associations wound up backing the bill. As for the rest of the economy, it will be hit by growth-slowing tax increases to pay for all that additional health care. That three-day chart could be a preview of the economy in Obama's second term, if he gets one.